Martech in 2022: Nearly 10,000 Software Tools Cataloged!

When the pandemic first struck in early 2020, some believed it could finally catalyze a reduction in the landscape of software vendors. In reality, the opposite has happened over the past two years. The drive to offer better digital experiences to customers and maximize online sales has accelerated the demand for tools and inspired a new wave of startups.

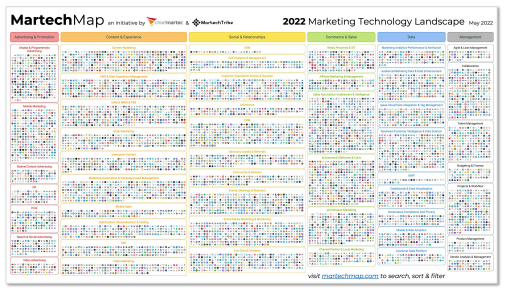

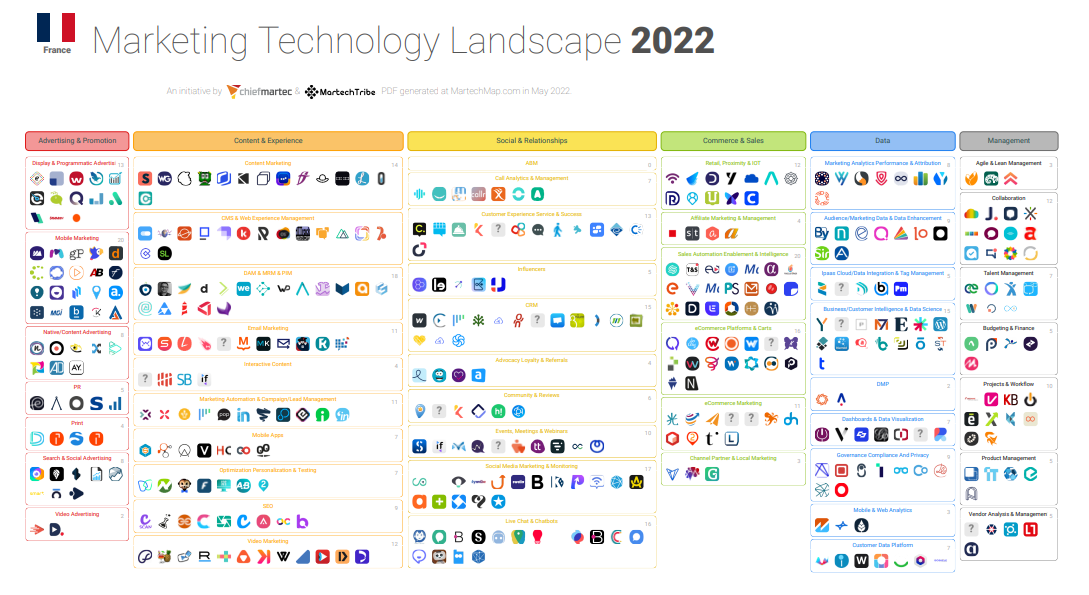

Here is an overview of the new marketing technology landscape as of May 3, 2022.

It includes 9,932 solutions, categorized into 6 categories and 49 subcategories. This "map" is now dynamically produced from a live data set, available for exploration at martechmap.com.

Nearly 2,000 new entrants have emerged since 2020. Over the past decade, since 2011, the number of marketing software tools has increased by +6,521%!

Each category of tools has grown, but some have experienced faster growth. Earlier in this article, we mentioned the categories of tools. Notably, each has seen a significant increase in the number of players over the past two years:

- Advertising and Promotion: 16%

- Content and Experience: 34%

- Social and Relationships: 17%

- Commerce and Sales: 24%

- Data: 7%

- Management: 67%

Among the fastest-growing categories are content and experience tools & commerce and sales tools. This is logical as these categories offer the greatest potential for differentiating customer experiences and online sales, which were premium topics in 2020 and 2021 with Covid.

However, the fastest growth by far has been recorded by management tools. With the rise of remote work, marketing teams have had to adapt their daily operations with more digital and collaborative tools.

Numerous Mergers and Acquisitions, Yet the Market Does Not Consolidate?

Yes, there have been many movements in this market over the past two years. Many Martech vendors have been acquired, dissolved, or pivoted to a different business model.

"It seems like every week I read about a significant acquisition between two providers. Yet the number of solutions on the Martech map continues to grow. How is this possible?"

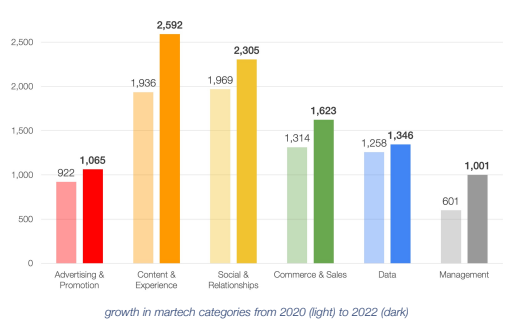

Indeed, the SaaS software industry for marketing has seen a high number of mergers and acquisitions. LUMA Partners, one of the leading investment banks in SaaS software, regularly tracks them: there were 157 in 2019, 85 in 2020, and 166 in 2021. About one in five was a transaction valued at $100 million or more, as illustrated below.

These (very) large acquisitions almost always make the news, especially on LinkedIn. Last year, there were 37. On average, that's 3 per month that likely made the industry's headlines. All these headlines naturally give the impression of massive consolidation.

However, although this consolidation effect is real, these well-known acquisitions do not significantly impact the total number of solutions and even in light of new entrants. In fact, during this time, new startups continue to enter the market in greater numbers. Ironically, consolidation often serves as a catalyst for the creation of new software players.

Leading Solutions Attract a Large Number of Small Players

Around the main Martech platforms (Google, Microsoft, Adobe, Salesforce, etc.), a multitude of small players connected to these platforms, aggregation systems, or add-ons are developing. They aim to provide simple, precise, and more comprehensive answers to specific use cases, where larger players must cater to a broad set of users and needs.

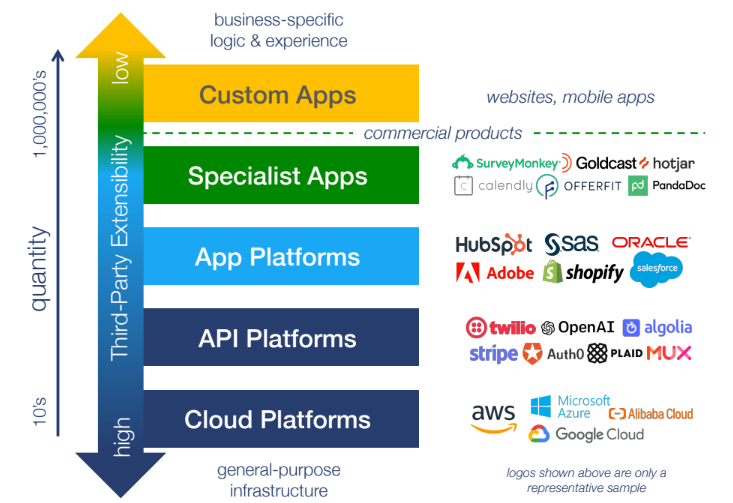

The growth of "Cloud" platforms (Amazon Web Services, Microsoft Azure, Google Cloud…), "API" platforms (Twilio, Algolia…), and "App" platforms, which aim to integrate with larger platforms (Salesforce, HubSpot, Oracle, Adobe…), has also accentuated this phenomenon.

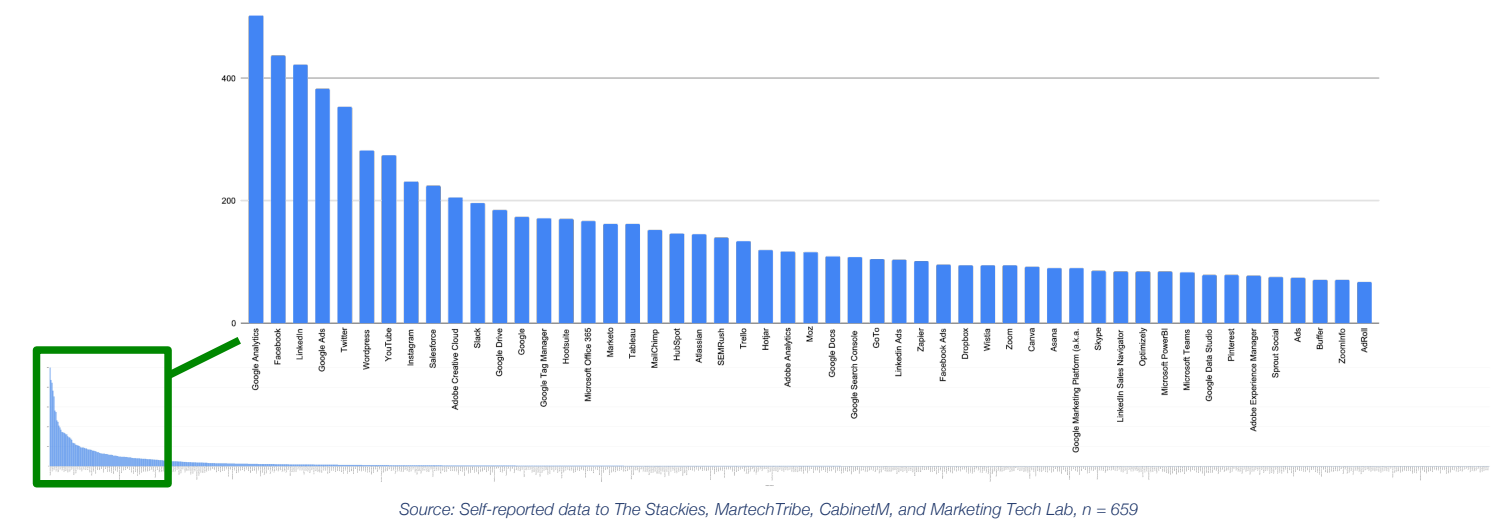

When we represent SaaS software based on their clients, a long-tail phenomenon becomes evident. The major, well-known solutions in the market are used by "all" companies (such as Google or Microsoft solutions). However, as we move towards more specialized solutions, their representativeness diminishes rapidly because companies adopt a variety of tools for their more specific needs.

Each Company, Its Software Model

The term "Martech stack," "tech stack," or "marketing stack" literally refers to the stacking of various marketing software solutions, more or less connected to each other, that can be used by a company.

Building a coherent stack of software tools, with data flowing and processes defined across multiple teams, is a strong differentiator, generating business.

Martech: Several Leaders Reveal Their Strategies

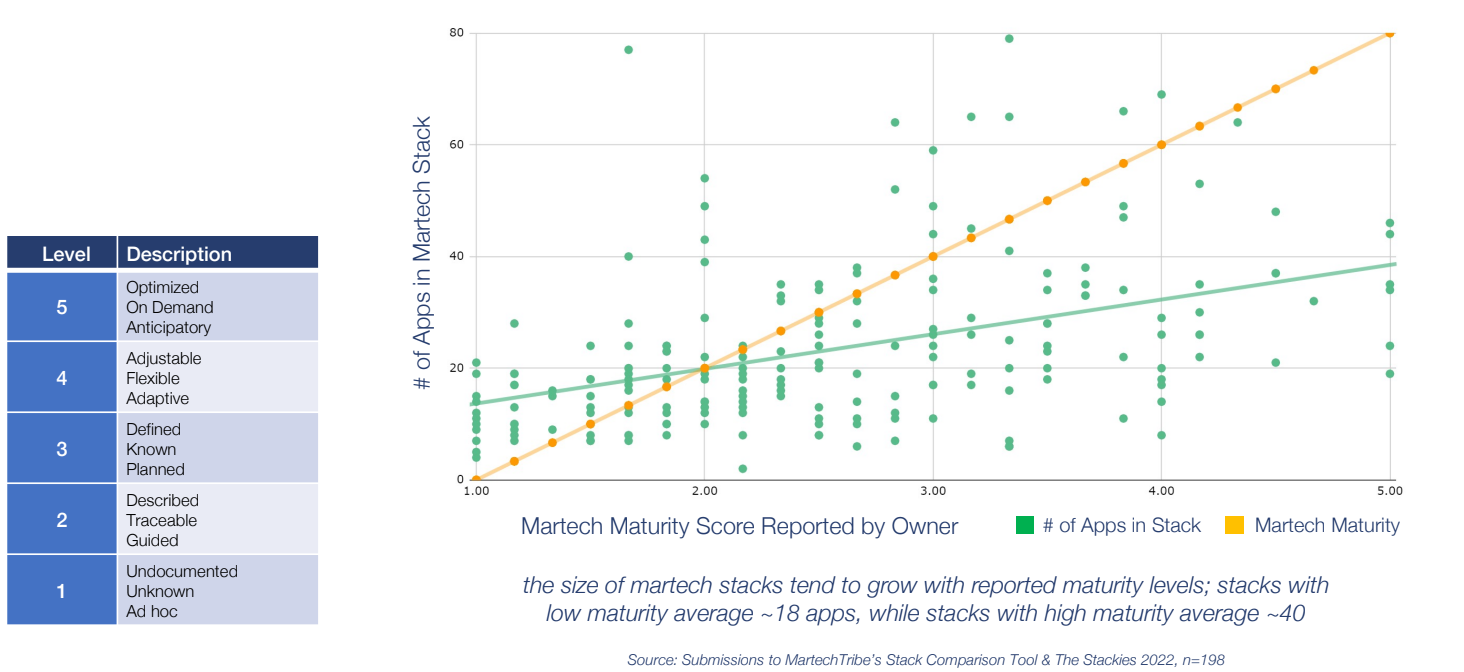

Alongside this mapping of SaaS vendors, 198 companies, each with a number of software tools, were asked to evaluate their software maturity. Although there is no direct correlation, companies with larger tool stacks defined themselves as having greater maturity.

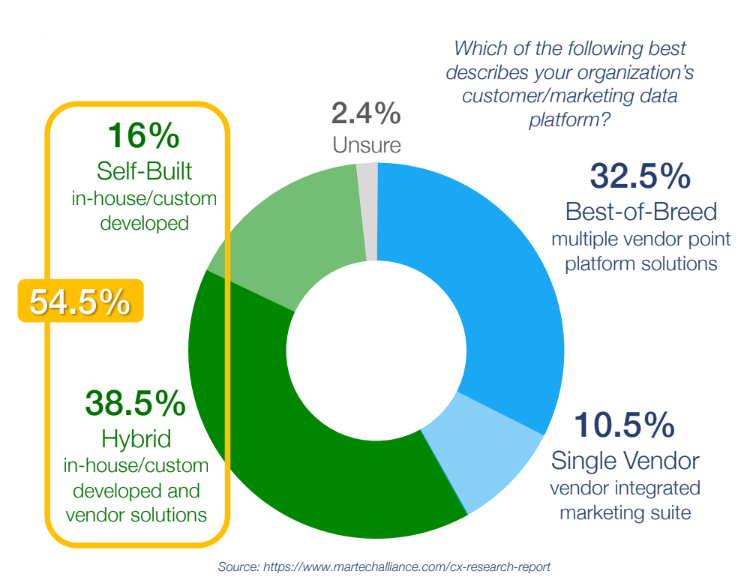

It is also interesting to note that Martech stacks often (for more than one in two companies surveyed) include custom or in-house developed software.

This is mainly due to the rise of low-code and no-code, lowering the technical entry barrier to create increasingly personalized tools for clients expecting a similarly personalized experience.

Over 430 French Software Solutions, a Strong Growth of 68%!

In conclusion, we offer this focus on France, where SaaS Advisor has fully contributed to mapping the different marketing technologies.

It is interesting to note that France has a varied ecosystem of solutions, with representatives in many tool categories. We refer you to martechmap.com and the "France" filter for more detailed information.